Tom Lee’s Latest Bold Prediction: Why We’re Still Early in the Bull Market

Wall Street may be flashing warning signs, but Tom Lee—one of the most consistent contrarian voices in finance—says we are only in the early innings of a bull market. Despite skepticism from other analysts, Lee points to historical data, structural trends, and the resilience of markets as proof that the rally has much further to run.

TOM LEE JUST MADE A MAJOR PREDICTION!

Tom Lee’s Track Record

For over five years, Tom Lee has been one of the most doubted analysts on Wall Street. Yet, time and again, his bold calls have proven correct. Even when he’s “wrong,” it’s often by only weeks before the markets move in his direction. That consistency is why many investors pay close attention to his forecasts.

Why This Isn’t Just a Relief Rally

According to Lee, what we’re experiencing now is not a “dead cat bounce” or a replay of 2021. Instead, it’s the textbook setup for a long-term bull cycle.

-

Back-to-back double-digit gains in the S&P 500 historically occur at the start of bull markets, not the end.

-

True bear markets are marked by exhaustion, failed rallies, and weak sentiment. None of these conditions describe today’s market.

-

Resilience has been the defining feature—stocks adapt, rebound, and push higher despite repeated macro shocks.

In Lee’s view, the strength we see now is being misread as froth, when it’s actually the foundation of a multi-year run.

Financials Could Trade Like Tech

One of Lee’s most striking predictions is that financials could soon be re-rated like software companies.

-

Banks today are weighed down by legacy systems, staffing costs, and reconciliation processes.

-

Blockchain and AI could radically simplify operations, cutting costs and boosting efficiency.

-

A bank like JPMorgan with 200,000 employees could, in theory, deliver services with fewer than 10,000 under new digital infrastructure.

The result: financials once viewed as “slow and stable” could trade with the margins and multiples of high-growth tech.

The Market’s Resilience

Think about the last five years:

-

The fastest Fed hiking cycle in history

-

Inflation at four-decade highs

-

Supply chain freezes and tariffs

-

Geopolitical conflict and energy shocks

Any one of these events could have broken markets. Instead, earnings expanded, companies streamlined operations, and margins widened. Lee argues that a market that survives six near-fatal blows and grows profits deserves a higher premium, not a discount.

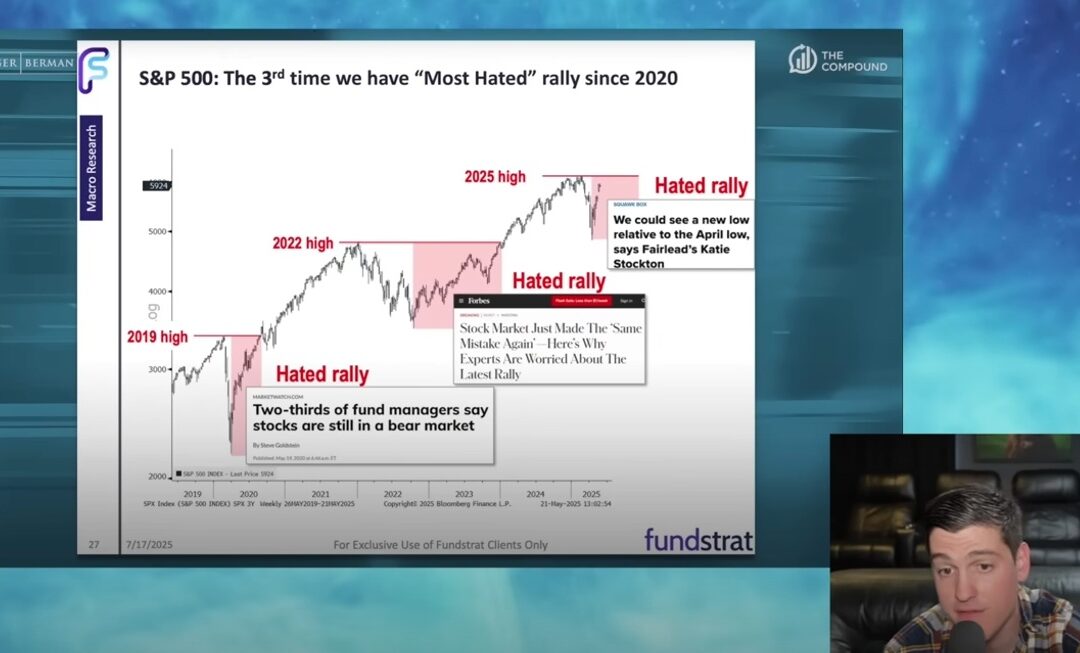

The Most Hated Rally Ever

Lee calls this the “most hated rally” because too many people missed it. When investors miss out, they root for markets to fall so they can re-enter at cheaper prices. This “wall of worry” actually fuels bull markets, as every dip is met with sidelined cash eager to buy in.

AI: The Heartbeat of the Bull Market

Lee places AI at the center of this bull cycle, stressing that it’s not hype—it’s already driving profits across multiple sectors:

-

Utilities: Powering data centers

-

Industrials: Building infrastructure for AI

-

Financials: M&A and flows into AI projects

-

Semiconductors: The backbone of AI computing

Unlike bubbles where valuations rise without revenue, AI is already expanding margins and improving balance sheets, making this a healthier growth story.

However, Lee warns that traditional SaaS is vulnerable. AI tools reduce the need for licenses and outsourced services, forcing a capital rotation into infrastructure and adoption plays instead.

A Broadening Rally

So far, big tech has led the market. But Lee sees the rally broadening due to:

-

Rate cuts – historically rocket fuel for small caps, financials, and industrials.

-

Manufacturing recovery – with the ISM index below 50 for two years, a rebound could kickstart years of growth.

-

AI expansion – spreading benefits to healthcare, logistics, retail, and energy.

Housing: A Coiled Spring

Lee predicts a refinancing boom once the Fed cuts rates and mortgage spreads narrow. Trillions in mortgage debt could be repriced lower, unlocking consumer cash for spending, renovations, and broader economic activity.

The Takeaway: “We’re Still Early”

Lee’s overarching message: the train has left the station, and it has a long way to run.

-

This isn’t a fragile rally—it’s a durable, adaptive market.

-

AI is a transformative engine for growth.

-

Financials and housing could see structural reratings.

-

The rally is broadening beyond big tech.

His warning to investors is clear: waiting on the sidelines for the perfect dip may leave you behind.

Sponsored Spotlight: Beline Holdings Inc. (NASDAQ: BLNE)

Alongside Lee’s bullish outlook, one emerging company worth noting is Beline Holdings, an AI-enabled digital mortgage platform streamlining one of the most outdated parts of finance: home lending.

-

Speed: Pre-approvals in as little as 7 minutes

-

Efficiency: AI-driven automation doubles loan processing productivity

-

24/7 AI Chatbot (Bob): Converts leads 6x better than human loan officers

-

Vertical Integration: In-house title company boosts margins and streamlines closings

With U.S. mortgage lending still dominated by slow, paper-based processes, Beline is positioned as a fintech disruptor in a multi-trillion-dollar industry.

For investors, BLNE represents a play on the digital transformation of real estate finance—an area where speed, efficiency, and automation could drive significant long-term growth.

Final Word

Tom Lee believes we’re only at the beginning of a long bull market cycle, fueled by resilience, AI, and structural shifts in finance and housing. Whether you agree or disagree, his call is a reminder: markets reward those who see past fear and recognize the early innings for what they are.

Crypto Rich ($RICH) CA: GfTtq35nXTBkKLrt1o6JtrN5gxxtzCeNqQpAFG7JiBq2

CryptoRich.io is a hub for bold crypto insights, high-conviction altcoin picks, and market-defying trading strategies – built for traders who don’t just ride the wave, but create it. It’s where meme culture meets smart money.